With its best third quarter ever, Nano Dimension (Nasdaq: NNDM) proves that smart investments and tighter operations can deliver big results—even in a tough market. The Israeli-based company ended Q3 with growing revenues, higher margins, and industry-shaking acquisitions that could redefine its trajectory.

Under the leadership of CEO Yoav Stern, Nano Dimension is making waves through financial growth and strategic moves, including two major acquisitions this quarter, Desktop Metal and Markforged. However, the company also faces shareholder challenges.

Nano Dimension’s third quarter had it all, starting with revenues surging to $14.9 million, up 22% compared to the same period in 2023, mainly due to increased sales of its product lines. Moreover, revenue for the first nine months of 2024 hit $43.2 million, an increase from $41.9 million year-over-year.

Quarterly results reflect a strong performance amid a challenging market for manufacturing equipment. Gross margins reached 48.2%, a 4% increase from the previous year, while adjusted gross margins climbed to 50.5%. The company also reported a significant reduction in net cash burn—down to $3 million from $16 million in Q3 2023—an 80% decrease attributed to “disciplined” cost management.

Net losses have also narrowed significantly. Excluding changes in holdings of Stratasys shares, the company reported a third-quarter net loss of $7.9 million, a dramatic improvement from the $26.6 million loss in the same quarter last year. Adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) improved as well, from a loss of $30.1 million last year to $14.8 million this quarter.

“Gross margin is 48%, up from 44%, and adjusted gross margin, which is without non-cash expenses, is 51%, up from 48%. This is extremely important because the business model of all companies in our industry suffers from gross margins and therefore from a lack of profits. When we get to 55% gross margins, we will start to show profits. This is very exciting,” Stern told investors during an earnings call.

Q3 Gains and Acquisitions

One of the most important announcements of the quarter is the acquisition of Desktop Metal and Markforged. Once integrated, the combined company will boast a technology portfolio that spans additive manufacturing systems for electronics, binder jetting for metals, fused filament fabrication, and more.

According to Nano Dimension, the acquisitions are expected to boost its revenue to $340 million. This number includes what the company and the acquired businesses would have earned together if they had operated as one entity throughout 2023.

Stern explained to investors that Nano Dimension had evolved into a $340 million business based on 2023 pro forma revenue. He says that starting with $56 million in organic revenue from its core operations, the company adds $190 million from Desktop Metal and $94 million from Markforged, forming the new combined revenue figure. What’s more, future efforts will focus on improving gross margins and profitability rather than chasing high revenue, said Stern.

Meanwhile, the executive compared the financial positions of competitors, highlighting Nano Dimension’s significant cash reserves of $475 million. This positions the company to invest in profitable growth while maintaining a solid balance sheet, unlike smaller competitors that are losing market position or being delisted (here, the CEO pointed to voxeljet, Velo3D, and Prodways).

Shareholder Tensions

Despite these successes, Nano Dimension faces ongoing challenges from activist shareholder Murchinson Ltd., a Canadian investment firm specializing in multi-strategy opportunities, including corporate actions and distressed situations. The firm holds roughly 7.1% of Nano Dimension’s shares and has been actively opposing the company’s current strategy and leadership.

In November 2024, an Israeli court ruled in favor of Murchinson, validating the results of a special general meeting held earlier in March 2023. This meeting, called by Murchinson, aimed to challenge Nano Dimension’s leadership, and its outcome included significant changes to the board structure. As a result of the court’s decision, Murchinson managed to place two of its representatives, Kenneth Traub and Joshua Rosensweig, on Nano Dimension’s board.

As tensions continue, Nano Dimension urges shareholders to support its proposals at the upcoming Annual General Meeting on December 6, 2024, including the reelection of CEO Yoav Stern and General Garrett, to protect the company’s future. Nano’s management warned shareholders that Murchinson and its ally Anson Advisors aim to gain control of half the board, a move Nano claims is intended to derail its progress and liquidate the company for their gain.

Nano Dimension’s concerns about Murchinson are not unfounded. The Canadian hedge fund has a history of pushing for major changes in companies it invests in, often challenging leadership and strategy. Additionally, Murchinson has faced regulatory scrutiny from the U.S. Securities and Exchange Commission (SEC). In 2021, the SEC charged Murchinson with violating short-selling rules under Regulation SHO, resulting in a settlement where the firm paid $7 million in penalties and other fees. That same year, Murchinson settled another SEC case tied to manipulative trading of DryShips Inc., where its actions caused the stock to soar 1,500% in just four days before crashing by more than 99%. The firm paid $8.15 million to resolve that matter.

Nano Dimension’s management argues that Murchinson’s plans would “derail the progress made,” a move they claim would destroy long-term value.

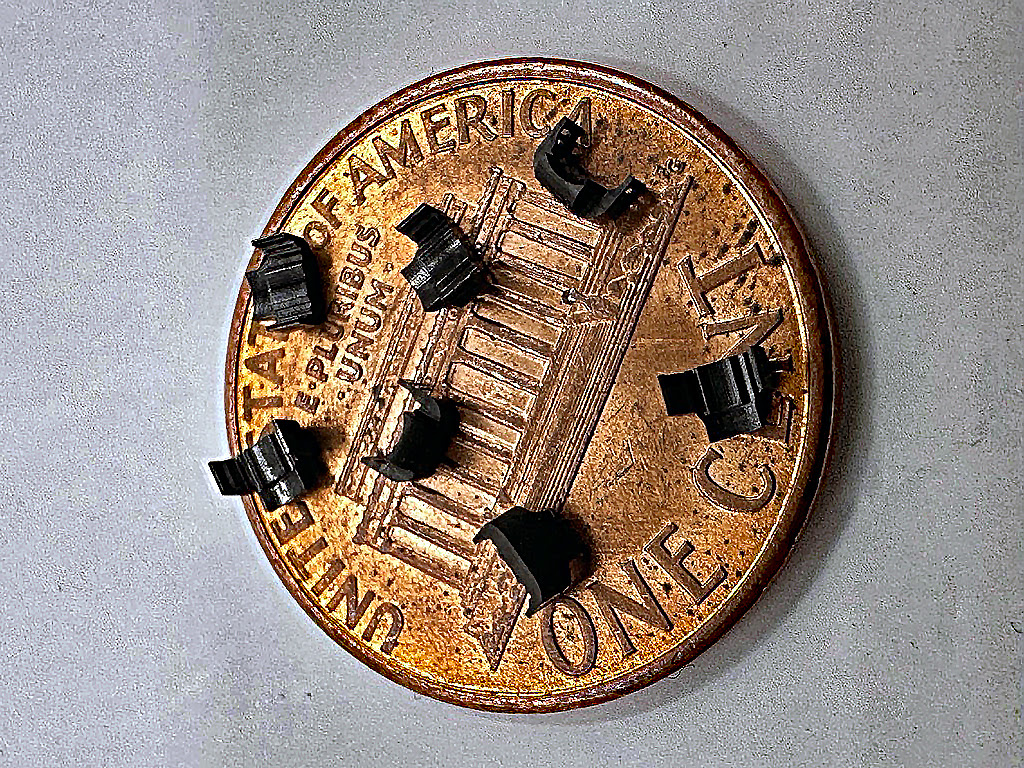

Nano Dimension used its Fabrica micro-3D printing technology to create a miniature medical device that accurately records neuronal activity in mice. Image courtesy of Nano Dimension.

Building a Resilient Future

Nonetheless, Nano Dimension’s outlook is beyond immediate financial performance. With a strong cash position of $475 million expected after the acquisitions, the company is well-positioned to weather economic challenges and invest in future growth. This capital will support innovation in 3D printed electronics and multi-dimensional polymer, metal, and ceramic additive manufacturing.

The company is also taking bold steps to align with high-margin industries such as aerospace and defense. Recent sales to Applied Materials, the University of Dayton, and a leading aerospace and defense firm show its ability to attract customers.

The company hopes to achieve positive EBITDA by the fourth quarter of 2026. To meet this goal, it plans to streamline operations, focus on high-margin opportunities, and leverage its expanded technology portfolio.

As Nano Dimension approaches its Annual General Meeting, the stakes are high. Shareholders must consider the company’s strong performance and clear strategy while dealing with pressure from activist investors. How the company handles challenges from investors like Murchinson will be crucial in shaping its future and role in the changing additive manufacturing industry.

Leave a Comment